Taxes

Tax Collector - Real Estate Taxes

Brenda Hill

401 Lincoln Way East

Chambersburg, PA 17201

(717) 263-6565

Franklin County Area Tax Bureau - Earned Income Taxes/Local Services Tax

306 North 2nd Street

Chambersburg, PA 17201

(717) 263-5141

Budget 2025

Chambersburg has the largest operating budget of any Borough in the Commonwealth of Pennsylvania. In 2022, the latest year with records, several municipalities failed to report their fiscal status to the State, and the impacts of the spending from the American Rescue Plan Act (ARPA) skewed the results. However in 2022, Chambersburg had the 8th largest budget of any municipality, and has the largest Borough budget statewide.

Obviously, Chambersburg’s budget size is because of its utilities and additional employees. Chambersburg is considerably larger and more complex than Carlisle, Waynesboro, Shippensburg or Gettysburg.

For example, Chambersburg’s budget is 13x times larger than Gettysburg Borough, which ranks #305.

Chambersburg Borough has the most complex budget in Pennsylvania. We are unlike every other town, including big cities. Separated from the other operations of the Borough, our utility financial transactions are in over a dozen separate funds (accounts). Our unique size is due to our expansive utility operations (unmatched in Pennsylvania) and because of our complex utility support operations (internal service funds). To account properly for expenses, we use cost-based accounting. Like a law firm or medical practice, many employees bill their time and equipment to the various functions upon which they are working. This includes money spent between the separate funds; many transactions are to cover expenses, back and forth between accounts, and thousands of internal transactions. This concept makes Chambersburg a unique government organization, especially in the Commonwealth.

Chambersburg is one of 35 Boroughs in Pennsylvania to operate a non-profit public power electric utility. Chambersburg is the largest municipal electric utility in the State, twice as large as the second largest, Ephrata, Lancaster County; and the only one to operate multiple generation stations. Chambersburg is one of two municipalities in Pennsylvania to operate a non-profit public natural gas utility. The other is Philadelphia, which does not operate an electric utility. Chambersburg is one of around 2,000 communities to have its own electric system and one of 1,000 communities to run a natural gas system, but one of only about 100 in the U.S. to operate both systems, out of 89,000 local government units. In addition, Chambersburg operates a regional water system and a regional sanitary sewer system; not through an independent authority or an intermunicipal board, but under Town Council supervision directly. Further, Chambersburg operates a sanitation utility, a traffic utility, an aquatic center, and a storm sewer utility. The Storm Sewer Utility was one of the first such storm sewer utilities to form under the federal mandate to regulate stormwater through the Municipal Separate Storm Sewer System (MS4) program.

Almost all employees of the Borough, and most of the equipment of the Borough, is owned and operated by our utility departments (Electric, Natural Gas, Water, Wastewater, Storm Sewer, and Sanitation utilities) and our utility support departments (engineering, motor equipment, and administrative services). Borough tax revenue does not support any utility operations, personnel, or equipment. Further, as the budget document reveals, the Borough’s utility rates are very reasonable.

Residents inside the Borough who have both Chambersburg electric and gas service can save as much as $2,000 per year when compared to similar residential customers outside the Borough.

Chambersburg Borough government and utilities are the catalyst for macro-economic expansion throughout Franklin County. More than the County Seat, Chambersburg drives costs for healthcare, banking, County-government, and the regional school district. By providing outstanding services and utilities to other institutions, Chambersburg is helping their bottom-line. We help other local entities afford their employees, their growth, controlling their expenses, and helping the greater Chambersburg area’s regional economy, by positively influencing so much economic activity.

Chambersburg real estate taxes remain earmarked only for police and fire operations. Real estate taxes are not the source of funding for any other department or employee. In fact, the three bond taxes now levied effective with this budget:

These three bond taxes are similar to mortgages. Therefore, one can reliably say, “No real estate tax will pay for any operations of the Borough of Chambersburg other than police and fire.” It is important to acknowledge that real estate taxes are not used in support of most departments, operations, or employees; not parks or street maintenance or the Borough administration, are paid for using real estate taxes. The only use of these taxes are police and fire, and to pay off the 2016 Recreation Bond, the 2022 Police Station Bond, and the new 2025-2026 Public Works Campus Bond. This has always been our financial plan for the Borough’s use of taxes.

Further, Chambersburg receives no sales taxes, no liquor taxes, no business taxes, nor hotel taxes. These types of taxes are not an option under State Law. In other states, these other types of taxes are the foundation to the fiscal health of local government. In Pennsylvania, the Commonwealth denies them as an option to communities like Chambersburg. Town Council has a toolbox with one tool inside (real estate taxes) and it is a dull and poorly honed tool, but that is the only tool given to them by the laws of the Commonwealth of Pennsylvania.

In addition to the need to update the county tax system, overall, the State’s outdated tax system is full of poor rules and State mandates, which puts every municipality at risk of financial distress.

On October 7, 2022, the Pennsylvania Municipal League and Pennsylvania Economy League released a new study that demonstrated how the current local taxation structure, developed in 1965, does not meet today’s municipal revenue needs. Called, “It’s Not 1965 Any More – State Tax Laws Fail to Meet Municipal Revenue Needs”, the publication is in response to the League’s Strategic Plan that called for an updated report on Pennsylvania’s local taxation structure. Pennsylvania’s municipal tax authorizations have failed to keep pace with modern realities, and municipalities need more flexible revenue options just to keep the lights on.

According to these experts, “Much has changed in the landscape of local government since 1965 – population shifts, aging housing stock in older core communities, increased cost of municipal services, and increases in tax-exempt properties receiving services. Currently, new tools are only available to communities that have become fiscally distressed. Municipalities need access to these proven tools before fiscal distress sets in. Tools should be optional to allow each community to decide the best mix based on the make-up of the community such as: increased Local Services Tax, flexibility to increase the Earned Income Tax, Payroll Tax, county or regional Sales Tax, Drink Tax, or a regular reassessment...” process.

Chambersburg is a member of the Pennsylvania Municipal League.

https://pelcentral.org/wp-content/uploads/PEL-2022-PML-Report-1.pdf

This budget reflects the limitations of the 1965 funding system, as well as the extremely poor planning by Franklin County, the last county of the 67 counties in Pennsylvania to update their taxation system. The continued dereliction of this requirement defined by State Law has a direct impact on poor tax collection, and an over-burden on older property owners as a result of waiting so long and ignoring the current tax system. Only our County leadership can address this shortcoming.

Chambersburg does receive income beyond the property tax. Ancillary miscellaneous tax revenue available to the Borough of Chambersburg amounts to: a wage tax set to a State mandated maximum rate; a local services tax (worker tax), which is set to a State mandated maximum rate; and a deed transfer tax (for real estate transactions), which is also set to a State mandated maximum rate. These so-called Act 511 taxes are important, but cannot be adjusted year-to-year based on need or economic realities. Therefore, they are minor, appreciated, and set by the State since 1965.

Each year, the payment and receipt of tax revenues grows slightly as the value of Chambersburg real estate grows slightly. We have a mixed record for our wage tax and our worker tax. It seems that both employment in the Borough, as well as Borough residents' income, is on the rise. Finally, there was no shift in the yields from transfer of property, which are sometimes better or worse in any given year.

Real Estate Tax Changes

From time-to-time the Borough of Chambersburg has adjusted real estate taxes. This budget contemplates such an adjustment for 2025:

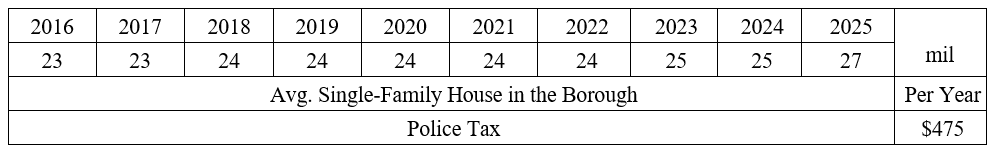

1- The Chambersburg Police Tax will rise for the first time in two years from 25-mil to 27-mil to offset the cost of adding three (3) new police officers.

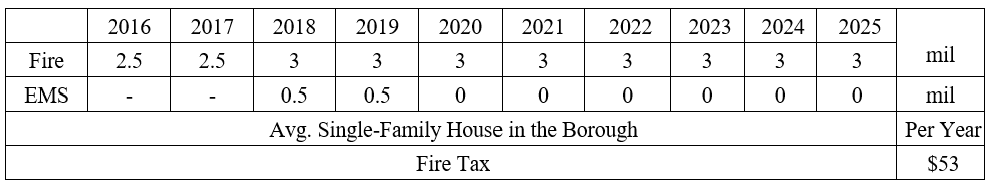

2- The Chambersburg Fire Tax cannot be increased as it is at a State-mandated maximum rate.

3- The Recreation Bond Tax will not change.

4- The Police Station Bond Tax will not change.

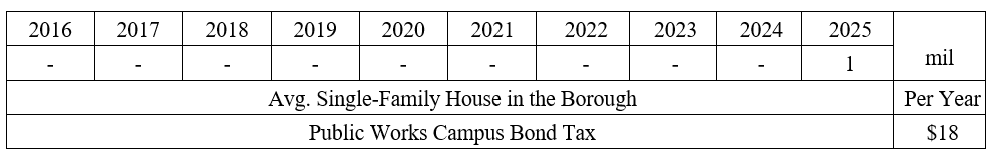

5- A new Public Works Campus Bond Tax will be added to the list of real estate taxes.

What of the Police Tax in 2025?

In our area, Chambersburg is the only municipality with a full service, round the clock, local police department. It is a professional and successful law enforcement organization. In 2016, Town Council appointed a new Police Chief, Ron Camacho; a highly qualified law enforcement professional. He has installed a series of upgrades in the organization and their standard operating procedures since joining Chambersburg. In 2021, Council supplemented the Police Department leadership by adding a Police Inspector to the squad, in addition to the Chief and the Lieutenant. In 2023, it remains very expensive to operate a high performing police department, but unlike our neighbors who have chosen to rely on the Pennsylvania State Police, the Chambersburg Police Department plays a much more proactive role in public safety within the corporate boundaries of the Borough.

Chambersburg remains an incredibly safe community with very low crime rates, despite perceptions otherwise. In fact, with their intense crime-prevention and crime-solving tools, a record decrease in crime is the single biggest accomplishment of the Police Department.

Many township residents have no idea that they have no local police in their community. I have nothing but respect for the Pennsylvania State Police, but they are not a local police force and they cannot provide the exact same response or services as the Chambersburg Police Department does in the Borough.

Until 2014, 100% of the real estate taxes collected by the Borough were used exclusively to support the Chambersburg Police Department. In 2014, a small share was added to support the Chambersburg Fire Department. While the Police and Fire tax rate grew in 2018, this remains the sole operational use of real estate taxes. Perhaps this explains why Greene, Guilford, Letterkenny, and Antrim townships have no local real estate tax. The Borough collects almost enough Police Tax to pay for the cost of operating the Police Department. Every dollar of designated revenue from the Police Tax is used wisely by the Police Department.

In 2022, the separate Police Station Bond Tax was added. This special bond tax does not cover any of the cost of the operating the Police Department. All of the money collected by the bond tax goes to pay for the annual debt payments for the renovation and expansion of the Borough Police Station, which reopened on S. Second Street in 2023. So while this extra bond tax is another tax to be paid by the taxpayers, it is not associated with any public safety services.

Two problems confront the Police Department. First, the time has come to expand the police force which has not expanded in size in over a decade despite the fact that the community has become more increasingly complex. The 2025 Budget includes a recommendation to hire three (3) additional police officers. This will help the police address a variety of issues including our growing traffic issues.

Secondly, the Police Tax is an issue. Not to get into the weeds on tax law, but all boroughs are at the mercy of their county Real Estate Assessment office. Our County, Franklin County, has failed to update the County tax rolls, the fair and equitable distribution of real estate taxes, since 1962. This is by far the oldest and most out-of-date taxation system in Pennsylvania. The practical impact of this decision by the County is to reduce the income that 1-mil of real estate tax generates. Unfortunately, the caps imposed by the State on a borough’s ability to raise taxes is not expressed in dollars, but is expressed in mil. Therefore, as a result of having an out-of-date taxation system, the Borough of Chambersburg can only raise the total number of mil of Police Tax to a maximum of 30-mil. And, in Franklin County, where 1-mil equals so few dollars, the Police Department funding is at serious risk of being impacted not by a shortage of dollars, but by this odd and antiquated taxation system. The County Commissioners have shown no desire to fix the system. Furthermore, a study, commissioned by six area boroughs, will likely show that the County system is not just out-of-date, it is arbitrary and manipulated. As a result, no one anywhere in Franklin County can have confidence that the amount they pay in property taxes is fair or equitable.

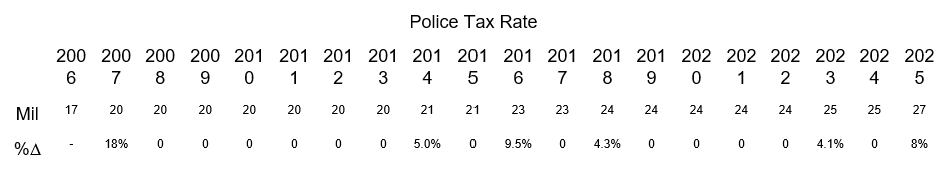

Regardless, with no fix on the horizon, the Borough of Chambersburg must hire more police officers. Further, to pay for those officers, the Borough must raise the Police Tax. The 2025 Budget recommends a change in the Police Tax from 25-mil to 27-mil; getting dangerously close to the statutory maximum of 30-mil. Overall, since December 2006, the Police Tax rate has risen from 17-mil to 27-mil. When averaged out over the eighteen years, that is a growth rate of a little over 2.6% per year. In 2025, it is the Borough Manager’s recommendation that the Borough adopt a Police Tax rate of 27-mil.

In 2024, it is estimated that the Chambersburg Police Department will cost just about exactly what is generated from the 2024 Police Tax (a small estimated surplus of $3,814). However, with increasing expenses to operate the Police Department, it is estimated that in 2025, the Police Department will cost $242,881 more to operate than all the revenues collected. This includes shifting police pension subsidies from utility departments to help the Police Department as well as the estimated yield of 27-mil of Police Tax.

Increasing costs for the Police Department include wages (both a cost-of-living increase and more employees), benefits, including health insurance, vehicle expenses (additional vehicle maintenance costs and additional vehicles), information technology expenses, and an increase in Workers’ Compensation insurance premiums. Together, department expenses grew $883,704 or by 14%.

As a result of those changes, a tax increase is needed.

In general, if the Police Department runs a deficit as it is anticipated to do so in 2025, it is commingled with all the revenue and expenditures in the General Fund. The General Fund miscellaneous revenue must cover it as it does with all the General Fund departments including Fire, EMS, the Recreation Department, Land Use & Community Development, and general highway, which are all mixed together pursuant to the State recommended chart of accounts.

It is important to place the anticipated Police Tax deficit for the Police Department of $242,881 into context. First, we will see how 2024 year ends financially because that helps inform 2025. Second, since 2020, given controls on spending and a slight increase in tax yield, the Police Tax will likely generate enough revenue to pay for approximately 100% of the Police Department (when including other police related revenues such as the shift in pension subsidy) in 2024. As is pointed out in this budget, it will be impossible to avoid a Police Tax rate increase. A deficit is not sustainable as it draws resources from other General Fund operations. Every dollar of undesignated revenue used to close the gap between these revenues and the Police Department budget is one less dollar that can be used for parks or recreation, highways or streets, or other functions such as economic development or new initiatives in community development.

Please keep in mind that we are operating the Police Department with very little margin for error. Unforeseen costs such as a major detective caseload, a major public safety event, additional unforeseen overtime, additional training, or adding more employees in advance of other future retirements, can easily throw the Police Department budget into a more unstable place.

What of the Fire Tax in 2025?

The Borough once had no Fire Tax. In 2014, a so-called neutral arbitrator imposed upon the Borough and the International Association of Fire Fighters (IAFF) Local #1813 a labor pact (the infamous “Kasher Decision”). Town Council was forced to add a Fire Tax. That tax was set at 3-mil and has remained unchanged. In exchange for this tax, and implementing the Kasher Decision, there was relative labor peace for the years following this decision. In fact, twice since then labor negotiations have avoided going back to interest arbitration for a resolution to impasses in negotiating new collective bargaining agreements.

Back in 2018, the Borough added a small (½-mil) Ambulance Tax to supplement the existing Fire Tax; the maximum permitted by State Law (1-mil updated in 2024). In 2020, Town Council replaced that Ambulance Tax with the Ambulance Fee, a surcharge on water invoices.

Unfortunately, in 2020 the Borough concluded that the Fire Tax was insufficient to pay for the cost of the Fire Department’s ambulance service. There is no legal way to raise it. The Fire Tax cannot exceed 3-mil and the now-repealed Ambulance Tax cannot exceed 1-mil under State Law (cap just raised to 1-mil in 2024). In 2020, Town Council repealed the ½-mil Ambulance Tax in its entirety and adopted the Ambulance Fee surcharge on water invoices in its place.

Our County, Franklin County, has failed to update the County tax rolls, the fair and equitable distribution of real estate taxes, since 1962. This is by far the oldest and most out-of-date taxation system in Pennsylvania. The practical impact of this decision by the County is to reduce the income that 1-mil of real estate tax generates. Unfortunately, the caps imposed by the State on a borough’s ability to raise taxes is not expressed in dollars, but is expressed in mil. Therefore, as a result of having an out-of-date taxation system, the Borough of Chambersburg can only raise the total number of mil of Fire Tax to a maximum of 3-mil as it has done in 2014. Henceforth, there is no possible way to raise the Fire Tax rate.

The Borough is once again at a financial crossroads with respect to funding the Fire Department and its associated basic-lifesaving ambulance service. The cost of these operations, coupled with the inability to collect all ambulance use-fees incurred and a state-imposed cap on the Fire Tax, has left the Borough in a precarious fiscal position. Meanwhile, the cost of Fire Department operations continues to rise.

There is no proposed change in the Fire Tax for 2025 because an increase is not possible. State law places a limit on the Borough at a very low tax rate for the purpose of paying for the Fire Department. Not that we like taxes, but the 1965 State Law makes no sense. The Borough is prohibited from levying more than 3-mil (the 2025 equivalent of about $640,605) in Fire Tax, but most of it must be used for apparatus/truck expenses and not for firefighters’ wages and benefits. Further, the Borough is prohibited from using more than 1-mil (the 2025 equivalent of about $215,843) for all the firefighter wages and benefits. Clearly, the State of Pennsylvania wants to inhibit the ability of any borough from having a paid professional firefighting force.

In Chambersburg, firefighter wages and benefits cost the Borough well over $4 million per year. Obviously, this artificial limit in place since 1965 does not envision a mostly paid and experienced professional fire department, as we have here in Chambersburg.

There is no logical or practical alternative and staff is at a loss how to pay for the Fire Department in the future. One alternative is to begin to rent the department to our township neighbors, assuming that their supply of volunteer firefighters disappears. This seems to be a logical assumption.

We believe the neighboring townships are ignoring the disappearing number of volunteer firefighters in Franklin County because they do not want to invest the millions of dollars necessary to have a professional force like the Borough of Chambersburg.

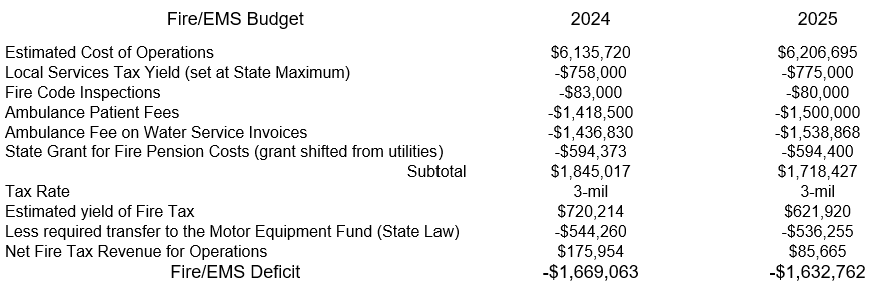

The long-term funding issue of the Fire Department is not identical to the issue of the Police Department. The main difference is that the Fire Department brings in significant revenue. Specifically, the Fire Department is a regional provider of Basic Life Support (BLS) ambulance service inside the Borough and in parts of the surrounding townships. While less than 50% of ambulance invoices are paid (and mostly by insurance), those payments are significant. In addition, the Fire Department acts as the Borough’s Fire Code safety inspection service. Done on a tri-annual basis for most commercial businesses (and annual basis for some types of businesses), this service results in fewer fires or loss of life, and provides some income for the Fire Department.

While the revenue from the ambulance service and the Fire Code safety inspections is not enough to pay for the cost of operating the Fire Department, this and the Fire Tax combined are counted as a very respectable effort to close the gap in costs. The balance of the Fire Department operating expenses is closed by undesignated General Fund revenue above and beyond the Fire Tax. Every dollar of undesignated revenue used to close the gap between these revenues and the Fire Department budget is one less dollar that can be used for parks or recreation, highways or streets, or other functions such as economic development or new initiatives in community development.

The cost of operating the Fire Department will rise significantly in 2025. This is in part due to higher costs associated with the replacement schedule for fire apparatus as we put aside money for future purchases. Vehicles for the Fire Department are rising exponentially in cost. This, plus the growing write-off for Medicaid/Medicare patients served by the Fire Department’s ambulance service, are causing strain on department finances.

In 2025, it is estimated that the Fire Department and EMS will cost $1,632,762 more to operate than the revenues collected. This includes shifting fire pension subsidies from utility departments to help the Fire Department as well as the estimated yield of ½-mil of Fire Tax permitted to be used for operations. There is no way permitted to raise the Fire Tax (approx. 7.9-mil more) to cover this deficit.

The Borough uses the Ambulance Fee to help cover the EMS portion of the deficit. The Ambulance Fee brings in $1.54 million. If the Ambulance Fee was used to cover the whole deficit, it would be set to $23.25 per month instead of the recommended $11 per month as is proposed for 2025. The proposed Ambulance Fee is made necessary by the allowance for uncollectable ambulance receipts as a result of Medicaid/Medicare federal rules.

In addition to the Ambulance Fee, if the Fire Department runs a deficit, it is commingled with all the revenue and expenditures in the General Fund. The General Fund miscellaneous revenue must cover it as it does with all the General Fund departments including the Police Department, the Recreation Department, Land Use & Community Development, and general highway, which are all mixed together pursuant to the State recommended chart of accounts.

The world of EMS is in such flux, we do not see any reason to not stay the course and give the process another year to unfold. Many believe the entire EMS system is on the verge of catastrophic failure.

More concerning than our fiscal status, or the delays in fielding a second ambulance, is the abject failure of volunteer ambulance companies (and some paid companies) to find employees/volunteers to staff ambulances and answer calls. There is reason to fear that the entire EMS system in Pennsylvania is on the verge of a breakdown. If such a prophecy comes to fruition, Chambersburg would remain in a strong and safe position. As a result of our commitment to professionalism, our use of firefighter personnel, and our willingness to use taxes and fees to supplement EMS operations, our community and our citizens are somewhat insulated from, what may turn out to be, a breakdown in emergency medical operations regionally or statewide. This is a very real fear throughout Pennsylvania.

Last year saw another dramatic change in Advanced Life Support (ALS) services in Franklin County as the system edged closer to a complete failure.

How this may impact us is both in an increased demand for our ambulance(s) to leave the Borough and provide regional mutual aid; and, second, by seeing a need to once again explore with whom the Borough contracts for Advance Life Support (ALS) paramedic services. As you may know, the Fire Department provides only Basic Life Support (BLS) services. Last year, for the fourth time in five (5) years, our ALS partner pulled out of Franklin County. Originally, we worked with West Shore EMS for these services, but their system failed and was acquired by Holy Spirit EMS, a division of the Geisinger Health System. In 2022, the Geisinger Health System merged with the Penn State Hershey Medical System. In 2023, the Life Lion and University EMS systems unceremoniously pulled out of Franklin County. As a result, Wellspan Health, in a dramatic move, stepped in to provide a partnership for ALS services.

If Wellspan Health decides to stop providing this service, there may be no one left in Franklin County and pressure upon our Fire Department to fix the failing system may reach a boiling point.

In 2025, we hope that these relationships, and our partnership, and the other BLS providers in our neighboring communities, all remain strong and stable. We hope, but we are prepared to act, just in case someone falters and we must act to protect the emergency medical systems in Chambersburg. Therefore, while no one wants to pay a fee to support ambulance services, please understand that such a fee is increasingly important. There are no alternatives. If there is a regional or statewide collapse of the EMS system, it will be Chambersburg and our commitment to funding, which will allow us to protect our residents and businesses. If the system collapses, we are prepared to pick up the slack and spend resources.

In 2025, it is suggested that Town Council support initiatives in Harrisburg to reform and change the EMS system in Pennsylvania. Support reforms that bring resources, clarify billing rules, increase billing options, and force regionalism of ambulance systems. In addition, urge Washington to fix EMS billing rules in Medicaid and Medicare. These rules, debated often by professionals and Congress, are hurting systems throughout our country.

We must lead the way at fixing the broken EMS system statewide.

How much does 1-mil of real estate tax yield in 2025?

Total assessed value of taxable real estate, inside the Borough, for 2025 is estimated to be $216,619,154; up slightly from last year’s assessed value. Therefore, the cash value of 1-mil would equal $216,619. However, when factoring in our average collection rate for any given year, we should expect that same mil to yield $201,456. This difference is a result of the average amount of taxes remitted on time, annually, versus the total that is levied.

Therefore, for budget purposes, 1-mil is equal to approximately $216,619 in cash. As explained, if you assume the standard percentage of taxpayers will fail to pay their taxes, 1-mil would equal $201,456 in cash. If you assume some old outstanding tax liens from previous years may pay their debts in 2025, 1-mil might equal $215,843 in cash. The value of a mil is therefore not precise.

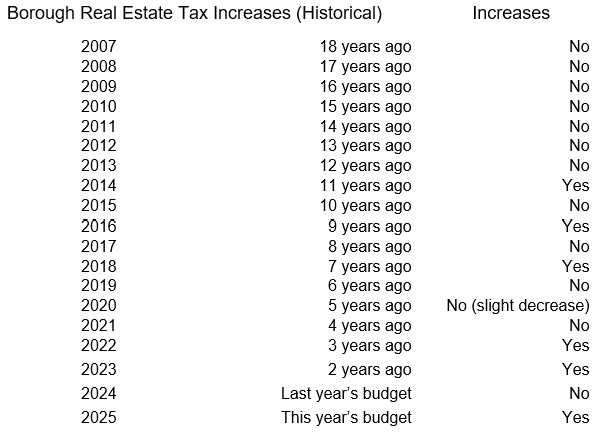

The Borough of Chambersburg did not raise real estate taxes between 2007 and 2013; then, the Council was very conservative with minor increases in 2014, 2016, 2018, 2022, 2023, and now, 2025.

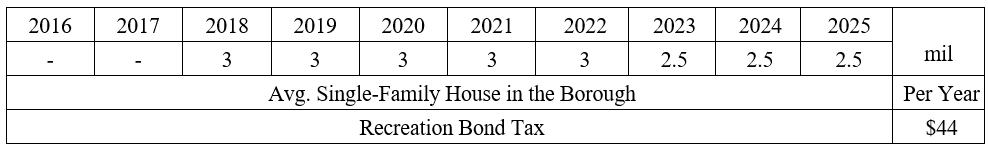

In most recent years, Chambersburg has not raised the real estate tax rate. Other entities often raise taxes that impact our taxpayers. Entities such as Franklin County or the Chambersburg Area School District can raise taxes and that sometimes leads to confusion. When the Borough raises the real estate tax rate, it is generally to fund police and fire services. In 2018, a tax was begun to begin paying off the 2016 Recreation Bond. In 2022, a tax levy was instituted to begin paying off the 2022 Police Station Bond. In 2025, a new tax levy will begin to help pay off the Public Works Campus project.

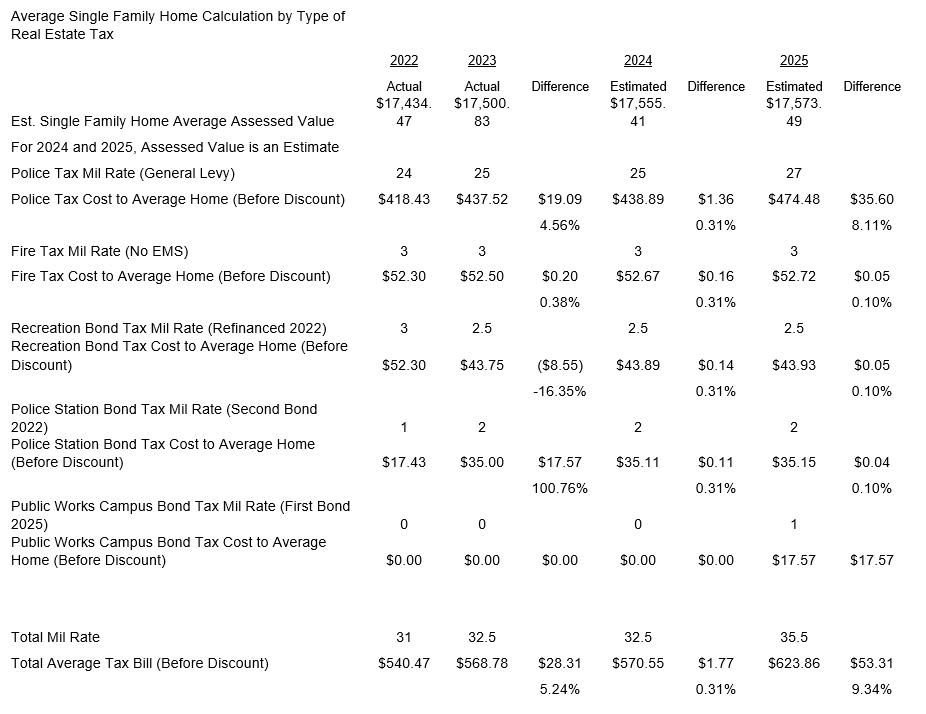

While a tax increase is never a welcome change, this year’s increase is directly related to two important factors, the hiring of three (3) additional police officers, and the beginning of the construction of the Public Works Campus. Further, for the average single-family home in Chambersburg, the cost of the tax increases should be about $4.44 per month or $53.31 per year.

Recall, Chambersburg is unique in our commitment to professional public safety and emergency services.

Approved 2025 Borough Budget Info

Chambersburg is the only town in Pennsylvania to have an electric, natural gas, water, wastewater, sanitation, and storm sewer utility. These utilities are never funded by local tax money.

With this budget, there are now five (5) types of real estate taxes collected by the Borough from Borough property owners. Each budget sets the mil rate and Franklin County sets the assessed value of your property. In order to permit the hiring of more police officers, this 2025 budget includes a Police Tax increase; no change to the Fire Tax; this budget includes a new Public Works Campus Bond Tax; and, changes to utility rates.

Police Tax 2025 – A 2-mil tax increase to fund the operation of the Chambersburg Police Department. Maximum rate per State law is 30-mil. 100% of this tax goes to support the Police Department only.

Fire/Ambulance Tax 2025 – No tax increase to fund the Chambersburg Fire Department & EMS. There is no change in the Fire Tax, and none is permitted under State law. Further, State law requires a split of the Fire Tax with at least 2-mil for apparatus & 1-mil for firefighting. The Fire Department collects other fees including inspection fees, Ambulance patient fees, and the Ambulance Fee surcharge on water service invoices.

Recreation Bond Tax 2025 – No tax increase to pay off the 2016 Recreation Bond (Refinanced in 2021). Started in 2018, this tax pays down this specific bond only and does not pay for any of the operations of the Recreation Department. This is the bond that helped build various Recreation Department facilities including the Aquatic Center, new tennis courts, new playgrounds, and a new roof on the Recreation Center.

Police Station Bond Tax 2025 – No tax increase to pay off the 2022 Police Station Bond. Started in 2022, this tax pays down this specific bond only and does not pay for any of the operations of the Police Department. This is the bond that helped build the newly reopened Police Station on South Second Street, the newly restored Clock Tower, and expenses related to the former temporary Police Station.

Public Works Campus Bond Tax 2025 – A new tax to pay off new bonds associated with this project. Breaking ground in 2025, this new tax pays down the specific bonds associated with 24% of the cost of construction of the new Public Works Campus on Wayne Avenue. The utilities will pay their fair share of construction costs as well. This tax is projected to rise in 2026 to 2-mil as the project is phased-in.

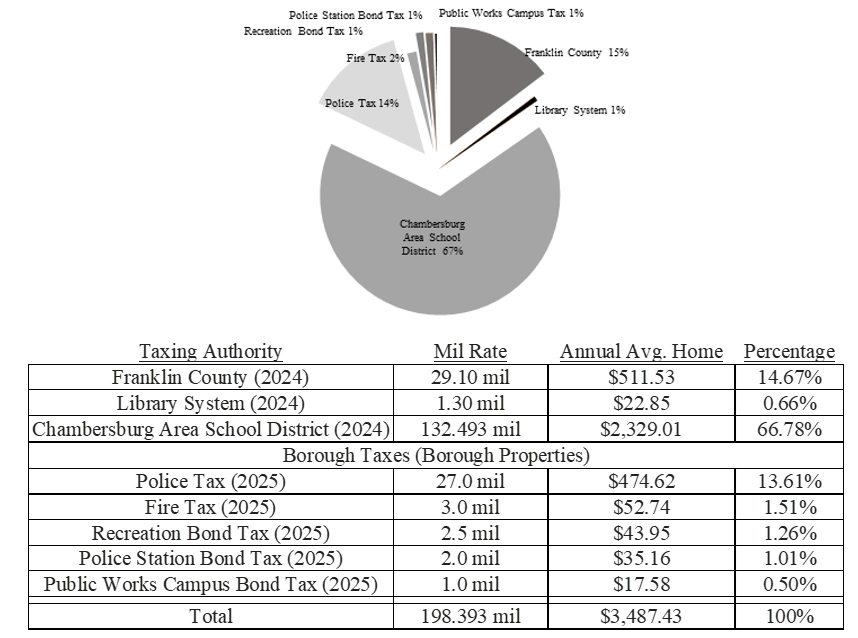

Property Tax Burden

Only 18¢ of every $1 paid in real estate taxes will go to the Borough of Chambersburg. The balance, 82¢, will go to support the school district, the county, and the library system. In fact, 67¢ of every dollar goes to the Chambersburg Area School District. They send their own tax bill.

Average burden on a single-family type home inside the Borough of Chambersburg based on assessed value as decided by County

Average burden on a single-family type home inside the Borough of Chambersburg based on assessed value.

The budget and tax rates for the Chambersburg Area School District are set by the independently elected School Board and not the Borough. The Borough has no say in these issues.

The budget and tax rates for Franklin County & the Library are set by the independently elected County Commissioners and not the Borough. The Borough has no say in these issues.

Unless you own property inside the Borough, or have a job inside the Borough, you pay the Borough no taxes. Further, if you just have a job in the Borough, you pay only $1 per week to the Borough and nothing else. In fact, almost no township residents contribute any tax money to the Borough. For example, the Sales Tax collected at stores inside the Borough all goes to support others, not the Borough.

The other state mandated taxes are set by law and are not changed year-to-year. They include the Local Services Tax, which is a $1 per week tax on workers inside the Borough; the Earned Income and Wage Tax, which is a set tax on wages earned by those who live inside the Borough; and the Deed Transfer Tax, which is a set tax when property inside the Borough is sold or transferred.

Together, along with fees and fines, these categories make up the only revenues of the Borough. In addition, the Electric Department and the Gas Department make a Payment in Lieu of Gross Receipts Taxes (PILOTs) to the General Fund. If these two departments were private corporations, they would pay taxes to the Commonwealth. As such, they are tax exempt. So instead, they pay their taxes to support your General Fund (police, fire, ambulance, highway, and recreation) activities.

State law prohibits the levy of taxes as a fee on persons (called per capita taxes) so we cannot invoice directly for police and fire services. Instead, the law allows us only to use property as the sole means to determine how much tax to collect. So, if you rent your property, your landlord will pay the real estate tax and it will be reflected in the rent you pay. There is no other system allowed. The Ambulance Club is not a tax or fee; rather, it is more like a service. You provide us a gift and in exchange, we accept assignment from your health insurance company if you need to use the Borough ambulance service.

Although Borough non-exempt real estate owners pay for the police and fire, they do respond to police and fire calls in the townships. State law requires that emergency services respond to all dispatches for health and safety. The Borough’s emergency services will always support our township neighbors regardless of money issues. We also enjoy the support of the various volunteer fire companies from the townships and the Pennsylvania State Police. Mutual aid is a very important principle in public safety.

However, can the Borough afford police officers and fire fighters when the money to pay for them can only come from such a small group of taxpayers? Unfortunately, the statewide system is broken. We can envision nothing but painful tax increases in the future to pay for growing police and fire expenses.

The local townships do not have police departments. They rely on the Pennsylvania State Police. They do not have township employee fire departments. They rely on the generosity of volunteer firefighters. All of the Borough’s local real estate taxes go for these functions. Moreover, while we might wish to not have paid police and fire departments, unfortunately we cannot go back.

Therefore, under the authority of state statutes, the Borough levies the following taxes:

- Local Services Tax (LST) - Determined by Town Council, and collected by the Franklin County Area Tax Bureau. The LST is assessed to all individuals working in the Borough, earning over $12,000.00 annually. The purpose of the LST is to assist with funding for the Borough's emergency services that are available to individuals who spend their work day in the Borough. The LST is withheld and submitted by the employer, at a uniform rate per pay period, over the course of the calendar year. For more information regarding the Earned Income & Net Profits Tax and/or Local Services Tax (LST), please contact the Franklin County Area Tax Bureau directly: 443 Stanley Avenue, Chambersburg, PA 17201, (717) 263-5141, www.fcatb.org

2024 Sample Borough Tax Bill